- EUR AUD Exchange Rate at 1.46 – Gains around four cents throughout the week

- Eurozone Jitters Weighs on Best Performance – Macron slips in polling

- EUR Forecast: Final Week of French Election Campaign Ahead – Vote on 7th of May

- AUD Forecast: RBA Meets Next Week – Dovishness could lead to further AUD weakness

While it slipped slightly from its highest level since October 2016, the EUR AUD exchange rate looked to sustain massive gains throughout the week overall.

Investors bought the Australian Dollar from its lows before markets closed for the week after a thoroughly poor April for the ‘Aussie’.

Could the Australian Dollar have a better time in May? As the Reserve Bank of Australia (RBA) has little to be hawkish about, next week’s RBA meeting is unlikely to make the ‘Aussie’ much stronger and could even cause further weakness for the currency.

[Published 12:26 BST 28/04/2017]

Due to a combination of a stronger Euro and a weaker Australian Dollar, the EUR AUD exchange rate has soared. Investors are generally optimistic about the French Presidential election and risk-averse market movement has led to poor ‘Aussie’ performance.

EUR AUD opened last week at the level of 1.42 but instantly surged to 1.44 due to French election news. The pair gradually gained throughout the week and on Friday was testing multi-month highs of 1.46.

Euro (EUR) Bolstered by French Election Hopes, Domestic Data

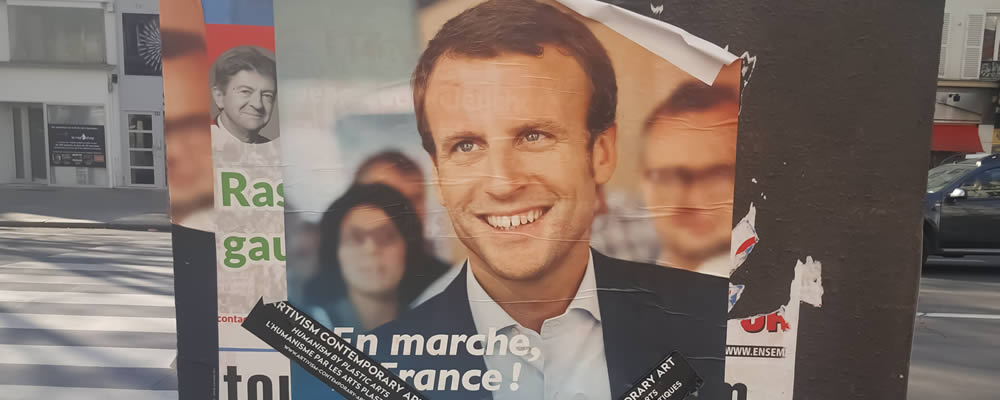

Demand for the Euro improved significantly at the beginning of this week when investors became more hopeful that pro-EU Emmanuel Macron would win the French Presidential election.

The Euro’s gains this week have been supported by data from the Eurozone, which has largely impressed traders.

Thursday’s German Consumer Price Index (CPI) projections unexpectedly improved from 1.6% to 2% year-on-year despite being predict to only rise to 1.9%. The monthly inflation stat slowed from 0.2% to 0%, just above the expected contraction of -0.1%.

Friday’s Eurozone stats were also mostly impressive too. While France’s Q1 Gross Domestic Product (GDP) projections weren’t as strong as hoped, Spanish growth beat expectations in both prints.

The day’s Eurozone inflation stats also impressed. Yearly inflation in France looked to rise from 1.1% to 1.2% in April, while yearly inflation in the bloc looked to improve from 1.5% to 1.9%, beating the projected 1.8%.

This increased hope among markets that the European Central Bank (ECB) could be pressured into tightening policy in coming months, despite a dovish tone from the ECB this week.

Demand for the Euro would have been even stronger if not for the cautious tone taken by the ECB during Thursday’s monetary policy meeting.

Analysts had been hoping for a more hawkish tone following recent data and the first French election results, but the ECB left monetary policy frozen and indicated things wouldn’t change any time soon.

In a press conference, ECB President Mario Draghi stated that while Eurozone growth was strong, inflationary pressures remained subdued, meaning loose policy was still needed. Draghi was careful to avoid speaking politics, claiming the French election did not factor into the bank’s plans.

Australian Dollar (AUD) Sees Poor Performance on Commodity Trade Concerns

Another poor week for the Australian Dollar has made the currency one of April’s worst performing major currencies.

Geopolitical concerns remain a considerable weight on ‘Aussie’ demand. As the Australian Dollar is considered a risky currency, it often struggles in highly uncertain market conditions.

The past week’s news of rising tensions between the US and North Korea, as well as investor disappointment with US President Trump’s proposed tax plans, have left investors hesitant to buy into risky currencies.

News that the US has increased trade tariffs on Canadian lumber imports has also dented demand for currencies with a strong correlation to commodity trade. Much of Australia’s economic growth is tied to commodity exports.

Lastly, Wednesday’s Australian inflation data fell short of expectations, denting market optimism ahead of next week’s Reserve Bank of Australia (RBA) meeting.

EUR AUD Exchange Rate Forecast: Final Week before French Election Concludes

Volatility is to be expected in the EUR AUD exchange rate in the coming week as the second round of the French Presidential election will take place on the 7th of May meaning there’s one more week for things to change.

Centrist frontrunner Emmanuel Macron has become market favourite to win due to his pro-EU stance, compared with anti-EU Marine Le Pen who wishes to withdraw France from the Eurozone.

However, Macron’s polling figures have dropped in the last week, from a lead above 60% to just 59% according to Presitrack opinion polls. If this downward trend continues, the Euro could quickly shed all its recent gains and be highly volatile in the coming week.

Next week will also be a big one for economic calendars in both the Eurozone and Australia.

Markit will publish its final April PMIs for the Eurozone early in the week. Other key Eurozone data due next week includes Eurozone unemployment for March, Q1 growth data for the bloc and Eurozone retail sales for March.

Over in Australia, the Reserve Bank of Australia (RBA) will be holding its May policy decision. After recent data, its tone is unlikely to be hawkish and if it’s more dovish than the last meeting the Australian Dollar likely has further to fall.

Either way, while the Euro outlook is pretty solid the EUR AUD exchange rate could go either way depending on how French election polls shift next week.