Weakening inflation data hasn’t prevented the EUR GBP exchange rate from recovering some ground after yesterday’s losses.

The EUR GBP pairing has bounced off a ten-month low today after slumping in response to news that the UK will vote in a snap general election on June 8th.

The Euro has been struggling with domestic election concerns for much of the year so far, but with just two trading days left before Sunday’s first round of presidential election voting, the common currency has found some strength.

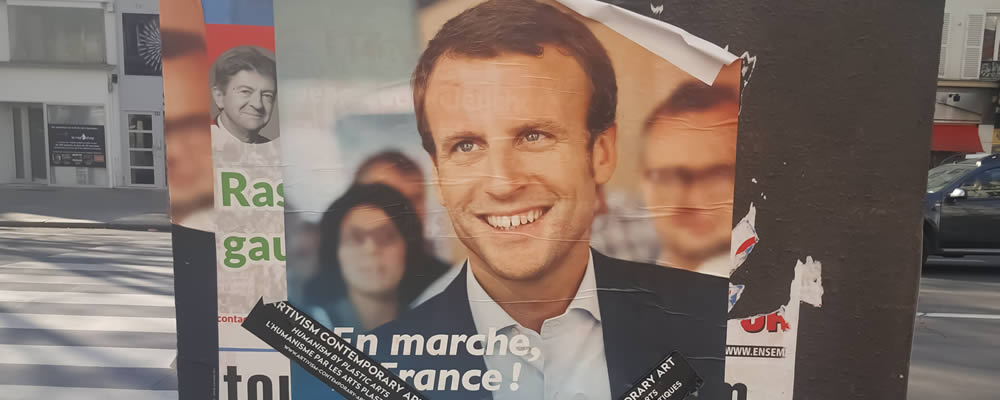

This comes despite the leading candidates, including market favourite Emmanuel Macron, seeing their lead in the polls softening, while Leftist and EU-critical Jean-Luc Melenchon has seen his support rising at the last minute.

Meanwhile, Eurozone data has shown that the pace of consumer price growth slowed in March from February’s 2% to 1.5%.

Month-on-month price growth rose from 0.4% to 0.8% as predicted.

Investors are not perturbed by these figures, however, as they were to be expected given that Easter falls late this year.

Additionally, core inflation was unexpectedly revised higher from the earlier estimate of 0.7% to 0.8%.

This is the measure the European Central Bank (ECB) will use to decide when monetary tightening is necessary, so an uptick bodes well for the interest rate outlook of the currency bloc.

Other Eurozone data was also supportive, showing an 11.2% increase in new car registrations during March and a bigger-than-expected surge in the Eurozone trade balance.

On an unadjusted basis, the February trade balance increased from a deficit of -€0.6 billion to a surplus of €17.8 billion; over €1.5 billion more than forecast.

Seasonally-adjusted figures showed the surplus rose from €15.7 billion to €19.2 billion, beating forecasts by more than €1 billion.

The UK released no data, leaving Sterling vulnerable to a sell-off after investors saw an opportunity to take profit on the recent appreciation.

This paved the way for EUR GBP exchange rates to gain 0.2%, although this still left the pairing just above its worst levels since July 21st 2016.

Tomorrow’s Eurozone economic data is mostly considered low-impact, such as German producer price indices for March and Eurozone construction output for February.

However, the afternoon will see the finalised Eurozone consumer confidence figures, which could help support the Euro higher if they improve from -5 to -4.8 as predicted.

There is no UK economic data set for publication tomorrow, but Bank of England (BoE) Governor Mark Carney is set to give a speech, which could cause EUR GBP volatility if he references monetary policy.